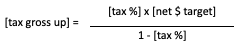

This post is specifically geared towards the number crunchers. And I’m going to post the formula in question at the top here, so that anybody who wants to earmark this page as a reference doesn’t have to scroll all the way to the bottom of the post to get the good stuff:

There are a few situations where a transaction changes the inputs of a formula and convolutes what would otherwise be straightforward arithmetic. Here’s what I mean by that.

Example 1: Fundraising. You’ve ironed out a pre-money valuation with your investor, but not an investment amount. The investor would like to own 10% of the post-money cap table.

Pre-money valuation: $100M

Target ownership: 10%

It would be easy to think that you would just invest $10M (10% of a $100M valuation), but the post-money valuation is going to include the cash from the investment. So your investor would have $10M of a $110M company… 9.09%!

How do we gross this up? 7th grade algebra, baby!

Your starting point looks like this:

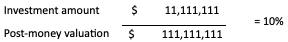

To be specific, with our example, it looks like this:

Run that through some 7th grade algebra (along with some 8th grade factoring) to solve for “inv” and you get:

Let’s check our work.

Nailed it.

Example 2: One other example of when this formula might come in handy is when you want to pay an employee for a specific expense (relocation, option exercise, etc.) but the amount you are targeting is net of taxes. If your new star hire needs $10,000 for moving expenses, you can’t just cut a check for $10,000. That puts maybe $6,500 in their pocket after tax withholdings. Let’s run it through the formula.

Add the gross up to your target payment and you get $15,385. Pay that to your employee, withhold 35% and they get $10,000 in their pocket.

I’ve seen people use circular references and excel’s solver function to tackle this “gross up” issue, which I guess is fine, but it’s a pretty simple formula, and turning on circular references can be problematic. Also, using the formula allows you to show your work and retrace your steps when and if you need to review materials later on.