What does that even mean? This is a phrase that you’ll hear from bankers, investors and finance professors from time to time. Where you probably won’t hear it is on Silicon Valley or the Startup Podcast (though I would absolutely love to see a debt-focused Silicon Valley episode). That’s because debt isn’t sexy. You have to pay it back. "Home mortgage" is possibly the least sexy term in the lexicon of personal finance. Fun fact: the etymological source of the word “mortgage” is “death pledge”!

Venture Capital is sexy. It’s money from a really smart, really accomplished investor who is saying “I believe in you” with a seven or eight figure check. You pitched your heart out and you won their confidence, and now you are tasked with returning >10X on that investment.

As a result, here in Startupland we don’t talk about debt perhaps as often as we should. So let’s talk about that “cheaper” assertion. Equity is money invested in the company that you don’t have to pay back. Debt is money loaned to the company that you have to pay back with interest. So how is that cheaper?

Enterprise value is how.

An example:

Company X has made their way to their first product launch and they want to raise $10M. So they start pounding the pavement, hit it off with a VC and get their $10M Series A round at a $40M post-money valuation. Right off the bat, the founders have sold 25% of their company. So payouts in a potential sale of the Company look like this (assuming the founders owned 100% of the company before the investment, for simplicity):

So you can see that 25% = 25% = 25% and the more the founders increase the value of the company, the more they have given up in terms of exit dollars.

Now let’s do the same example with Company Y, who has raised debt with the following terms:

$10M of principal

6% effective interest rate

5 year term

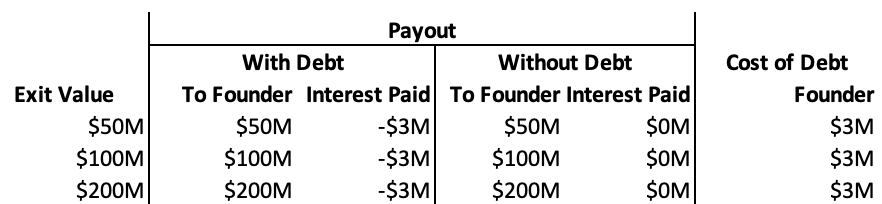

If we further assume that Company Y achieves an exit in exactly 5 years (how convenient), the same payout matrix looks like this:

Note: the interest calc is 6% x $10M x 5 years = $3M

No matter at what valuation the exit occurs, the cost to the company is the same. Comparing the cost of equity vs debt at each exit value looks like this:

Note: the aforementioned finance professors would also want me to discuss the additional tax benefits of debt here, but since many exits occur before companies get to profitability, let’s leave it alone for now.

Great. Debt is cheaper. Why would anybody accept equity investment? Plenty has been written about the debt vs equity question, so I won’t rehash the whole discussion. A few of the better write-ups can be found here, here and here.

I can try to distill (oversimplify?) it though: when you need to make a big bet, and the future is uncertain but really compelling, accepting the funding and expertise of an investor makes a lot of sense. But if you have a tangible need (inventory, marketing collateral, manufacturing tooling, etc.) and your business is predictable enough to map out how you will be able to pay back a loan, then debt may be the way to go.

*****

Questions, comments, requests for blog topics? Email blog@gtxfinance.com. Sign up to follow the blog here.